Bridging the Oil and Gas Skills Gap: Effective Technical Training for Current and Future Employees

Click HERE to view Bridging the Oil and Gas Skills Gap: Effective Technical Training for Current and Future Employees as a multimedia presentation.

Click HERE to view Bridging the Oil and Gas Skills Gap: Effective Technical Training for Current and Future Employees as a multimedia presentation.

What does 2020 and the coming years hold for industries around the globe? That’s the question on the minds of many executives as they embark on a new year and a new decade. For the oil and gas industry, a skills gap will continue to create problems for employers looking to seize new opportunities for increased efficiency and profitability. Effective technical training for current and future employees will be a key strategy necessary to solve this problem.

In this article, we’ll take a closer look at what 2020 holds for the oil and gas industry, including the reasons behind and current state of the skills gap in the industry. We’ll consider how companies are using training programs to upskill current workers and ensure future workers have the skills they need. Finally, we’ll look at how DAC Worldwide’s unique oil and gas training tools can help employers and educators to bridge the skills gap facing the oil and gas industry.

2020: Opportunities and Challenges

The oil and gas industry has rebounded from the economic downturn experienced several years ago. According to Deloitte’s 2020 Oil, Gas, and Chemical Industry Outlook, there are several reasons for optimism in the new year: “Liquid natural gas (LNG) keeps growing…[f]ossil fuel consumption is expected to continue to grow…[and] [g]lobal…oil supply remains secure thanks to growing US production and healthy stocks.”

The Deloitte report concludes that oil and gas executives need to be “ready to embrace new opportunities for profitable growth…Thanks to the lessons learned from the most recent boom and bust cycle, the industry is better equipped to face the future than it has been at any other point in the past decade. Still, there are fundamental, long-term challenges that they will have to face.”

The 2019 Global Energy Talent Index (GETI) Report agrees, noting that “[t]he oil price has rebounded and new projects are on the rise. The challenge now for the sector is to ensure that the talent supply can keep up with demand.” Why? Quite simply, “[m]aintaining a pipeline of new talent has become a challenge for oil and gas companies.”

The Oil and Gas Skills Gap

A recent Energy Sourcing article notes that, in the coming decade, the “U.S. Bureau of Labor Statistics expects 54.8 million total job openings [in the oil and gas industry],” but there are “not enough skilled people to fill them.” What is behind this skills gap? Experts point to a variety of factors that have contributed to the growing shortage of skilled talent in the oil and gas industry.

Too Few Millennials, Too Many Boomers

According to the 2019 GETI Report, “the impact of economic cycles on job stability is a leading cause of the skills shortage.” During the recent economic downturn, jobs were cut and recruitment efforts were severely curtailed. The result has been the slowing of “[t]he influx of young talent into the sector,” leading to the present “talent crunch.”

Now that the industry is back on the upswing, employers are trying once again to attract young talent, but they’re finding it’s not as easy as it used to be. As a recent Airswift article notes, oil and gas employers are learning a hard lesson: “The skills gap is a problem that money alone can’t solve.”

Not only is oil and gas “the number-one industry millennials wished to avoid working in because of its image,” but competition for young, skilled talent is fierce because the skills gap affects nearly every industry around the world.

Adding to the problem of the short supply of young talent is the fact that “[o]lder workers from the Baby Boomer generation are beginning to reach retirement age, ultimately heading off and taking decades of knowledge and experience with them.” Who will replace them?

Industry 4.0 Changes

Industry 4.0 Changes

Whoever does replace retiring workers will have to possess a stronger technical skillset than ever before. In addition to skills specific to the oil and gas industry, they will need advanced technological skills that will enable them to succeed as the industry experiences the dramatic changes characteristic of the Fourth Industrial Revolution, otherwise known as Industry 4.0.

Industries across the board and around the world are being impacted greatly by Industry 4.0’s technological advances. Oil and gas is no exception. As the Airswift article notes, “oil and gas companies are collecting more and more digital data which is helping to improve worker safety, monitor reservoir behaviour, plan ahead for smoother digs, maintain hardware and much more.”

They’re also incorporating new technologies, such as drones. According to the Oil and Gas Drone Services Market – Growth, Trends, and Forecast (2019-2024), the market for drone services in the oil and gas industry is expected to grow by more than 60% in the next five years.

As a Business Wire article summarizing the drone forecast notes, “[d]rones are being used for inspection to determine any damage or corrosion and to provide data for structural integrity and visual and infrared photography,” as well as for “pipeline inspection, corrosion checks, security checks, and maintenance issues.”

Positions Aplenty

Positions Aplenty

In addition to new positions, such as drone pilot and drone fleet manager, the oil and gas industry features a wide range of high-priority roles impacted by the skills gap. According to a recent study by RAND Corporation, the sector needs plenty of “lease operators (also known as well tenders), equipment operators, maintenance and service technicians…electrical engineers…welders, pipeline layers…commercial drivers…machinists [and] warehouse operators.”

The 2019 GETI Report also notes that “the pool of available, blue-collar talent has shrunk rapidly. These skills are proving to be the most urgent of needs…In the US, blue-collar skills are more in demand than engineering roles.”

The Airswift article summarizes things succinctly:

“There is a very real problem standing on the doorstep of oil and gas companies, and it is one that needs a huge amount of effort and foresight to solve for long-term growth and success. We’re talking about the industry skills gap which is crippling energy companies, holding up work and causing projects to go over budget…More than half of professionals in the industry across the globe believe that a growing skills shortage is by [far] the biggest challenge the industry faces both now and in the future.”

Technical Training to the Rescue

As the Airswift article makes clear, oil and gas companies are learning that the skills gap is a problem that won’t go away just by throwing money at it. It requires a multifaceted approach with coordination between a variety of stakeholders, including employers, educators, workforce development programs, and even local, state, and federal governments.

Ongoing Training Is Key

Ongoing Training Is Key

While long-range plans are set into motion, employers still must do what they can in the meantime. Airswift notes that the 2019 GETI Report’s survey found that nearly two-thirds of respondents believe “companies should be turning their attention internally and retraining existing employees to deliver the skills they need to bridge the gap.”

The author of the Energy Sourcing article agrees: Training current and new employees with cross-functional skills “may be the quickest answer to the industry’s current hiring challenges.” Another strategy many employers consider is luring skilled talent away from other industries.

However, bringing in people from other disciplines isn’t a “plug and play” phenomenon. Instead, the Energy Source article points out that “when it comes to the required knowledge to be proficient in oil and gas exploration and development, they will need additional training in certain areas to enter this industry ready to be contributing members of the team.”

The oil and gas industry differs from other industries in that the wide variety of specialized skillsets it requires make initial and ongoing internal training a necessity. Two recent studies reveal the nature of this need.

The RAND Corporation study concludes:

“About half of employers (52 percent) reported employing high-priority occupations that require moderate-term on-the-job training (including inspectors, welders, and roustabouts) and about one in four employers (28 percent) reported having high-priority occupations that require long-term on-the-job training (including mechanics, machinists, and wellhead plumbers). Thus, for many of the oil and gas sector employers…it is essential to invest in and commit to providing on-the-job training to ensure their workers can adequately perform their duties.”

Similarly, SPE Research’s Training and Development Survey notes that “[u]pon starting a career [in the oil and gas industry], the majority (86.8%) of employees require training…[and] “[n]early a fifth (19.2%) required extensive training”…[and] [m]ost (82.4%) expect their employer to provide them with some of this training.”

More Than a Short-Term Solution

More Than a Short-Term Solution

The RAND Corporation study goes on to explain that training is much more than just a short-term solution:

“[A] sizeable number of high-priority occupations require long-term training…underscor[ing] the need for ongoing training and professional development after hiring to ensure that employees are getting training both for the jobs they currently have and for the jobs they might take in the future. Focusing on the workforce as a pipeline that supports careers rather than a single hiring transaction at entry is essential for sustaining the oil and natural gas industry over the long term.”

The SPE Research survey also makes a strong case for focusing on employee training as a means of not only empowering employees with the skills they need but also meeting their expectations for career development: “Overall, a wide range of skills are important for a successful career in the oil and gas industry; therefore employees place great emphasis on training and development opportunities when choosing their employers.”

The survey notes that “[i]t is important for companies to have good training and development programs, as three-quarters (74.6%) of employees state that it is important in their choice of role, and over half (53.3%) say that a lack of opportunities would be enough for them to consider leaving.”

Gaining Momentum

Gaining Momentum

It appears employers are getting the message, since “[e]ight out of ten companies provide at least some formal training as their overall approach to employee development,” and “[t]echnical training is the most common form of training provided by employers.”

This response is being echoed by other industries, including advanced manufacturing. For example, The Manufacturing Institute Training Survey recently made these key findings regarding training programs in the advanced manufacturing sector:

- “Nearly 70% of manufacturers are addressing the workforce crisis by creating and expanding internal training programs for their workforce, among other tactics.”

- “More than 79% of respondents said that they have increased their training activities.”

- “Three-quarters of respondents said that upskilling workers helped to improve employee productivity, with promotion opportunities and morale also leading the list of reasons why companies might embrace training programs.”

- “In dollar terms, the Institute estimates that the sector spent at least $26.2 billion in 2019 on internal and external training programs for new and existing manufacturing employees.”

Oil and gas companies would do well to follow the example set by manufacturers by taking on the responsibility “to build stronger pipelines to address not only the needs of their businesses but also the needs of their workers.”

Quality Matters

Quality Matters

What kind of training is necessary? The answer to that question will vary widely amongst oil and gas companies. Is your company upstream, midstream, or downstream? What roles are you having trouble filling because of the skills gap?

What will not change from company to company is the need for high-quality training that efficiently and effectively teaches current and future employees the skills they need to succeed on the job. This is particularly true for the oil and gas industry, given its broad scope of roles with specialized skill requirements.

Unfortunately, many training programs don’t meet the needs of the oil and gas industry. As the RAND Corporation study notes, “[l]ess than half of courses aimed at future workers in the oil and natural gas industry use contextualized instruction. Contextualized instruction uses occupational applications to teach basic academic skills (and vice versa) in such a way that the student learns both simultaneously.”

Teaching relevant skills in the context of the oil and gas industry is especially important because the industry is unique in so many ways. The most effective training will provide employees with hands-on experience with real oil and gas components. The RAND Corporation study supports this approach: “past research shows that contextualized instruction is an effective approach to teaching occupationally focused students…particularly when it includes ‘real-world’ simulations of workplace situations with actual workplace equipment.”

DAC Worldwide: Your Source for Effective Training Tools

DAC Worldwide: Your Source for Effective Training Tools

Oil and gas companies don’t need to recreate the wheel when looking for quality, effective technical training tools. Instead, they can rely upon a trusted training partner like DAC Worldwide to provide the guidance they need.

DAC Worldwide offers a wide variety of technical training tools specifically for the oil and gas industry. Importantly, these tools provide the contextualized, hands-on training current and future employees expect, want, and need.

Contact a DAC Worldwide representative to consult with you regarding your specific training needs. In the paragraphs that follow, we’ll take a look at just a small sample of the many training tools offered by DAC Worldwide, including training systems, cutaways, dissectibles, models, and sample boards.

Training Systems

Training Systems

Rather than broad-based training in multiple areas, DAC Worldwide’s training systems provide hands-on training focused on specific tasks. This makes them particularly helpful to employers for skill assessment (either pre-employment or for upskilling purposes).

For example, DAC Worldwide’s Vertical Separator Trainer (295-101) consists of a reduced-scale, three-phrase vertical separator that mimics its real-world counterpart by using alternate production stream components, refined oil, air, and water. It also features real industrial components, such as on-board supply pumps, a regenerative blower, a static mixer, metered valves, flowmeters, an inlet diverter, overflow weir, mist eliminator, and a custom-fabricated, large-diameter, clear acrylic, vertical separator vessel.

Cutaways

Cutaways

DAC Worldwide’s industrial component cutaways provide hands-on experience with real, industrial components that have been professionally sectioned to expose key internal components to help learners understand how they work. For industrial training relevance, common models by well-known manufacturers are chosen when manufacturing cutaways.

There are two dozen cutaways related to oil production to choose from, including a wide variety of regulators, valves, and gauges. For example, the Extended Wellhead Assembly Cutaway (295-795E) consists of a full-size, fully-detailed example of a high-pressure wellhead assembly that gives learners a first-hand view into a component found in oilfield applications worldwide. It features a variety of real industrial components learners will encounter on the job, including a casing head/starter head, tubing head, tree bonnet adapter, adjustable choke, and gate-type block valve.

Dissectibles

Dissectibles

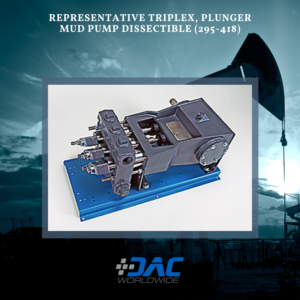

DAC Worldwide’s dissectibles take cutaways to the next level by allowing learners to disassemble and reassemble real industrial components. There’s simply no better way to train someone on the maintenance of a particular component than letting them disassemble and reassemble an actual unit. Plus, dissectibles provide experience with real components without damaging actual equipment.

For example, the Representative Triplex, Plunger Mud Pump Dissectible (295-418) is an economical, conveniently-sized triplex plunger-type mud pump assembly that teaches learners hands-on maintenance activities commonly required on larger mud pump assemblies used in upstream oilfield production operations. DAC Worldwide’s dissectible mud pump is a realistic sample that’s similar in geometry, design, and operating characteristics to the larger varieties learners will encounter on the job.

Models

Models

DAC Worldwide also offers a variety of incredibly-detailed, intricately-crafted models. Sometimes industrial training tends to focus so intently on the details that learners can’t see the forest for the trees. Models allow students to learn how the parts of a system work together on a small, easily-managed model without the need for a field trip to an industrial site.

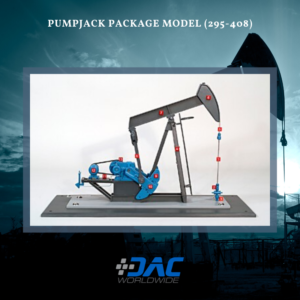

There are more than a dozen models related to oil production to choose from, including separators, tanks, turbines, pumps, and piping systems. For example, the Pumpjack Package Model (295-408) is a highly-detailed, professionally-crafted technical scale model of a common oilfield production pump. Fully-detailed, this benchtop model depicts all primary pump features including counterweights, double-reduction gearbox, walking beam, horse head, sampson post, prime mover, pitman arm assembly, and representative wellhead.

Sample Boards

Sample Boards

DAC Worldwide’s sample boards offer valuable maintenance training in the identification and selection of a variety of industrial components. Each sample board features a selection of real industrial components mounted with nameplates for easy association with individual components.

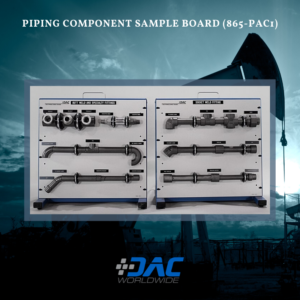

For example, the Piping Component Sample Board (865-PAC1) is a hands-on teaching aid designed to supplement courses in piping design, process operations, and pipe installation to help industrial maintenance technicians identify and select industrial piping components. Components from four common piping systems are provided. These samples represent a variety of piping system designs and include a broad range of fittings.

We encourage you to connect with DAC Worldwide via its social media channels, including YouTube, Instagram, LinkedIn, Twitter, and Facebook.

- Published in News