EPA Incentivizes Oil and Gas Companies to Reduce Methane Emissions

Is it fair that climate change scientists have laid much of the blame for global warming at the feet of the oil and gas industry? Perhaps. A recent EHS Today article notes that the Environmental Protection Agency (“EPA”) states that “[o]ne sector – oil and natural gas – is responsible for almost one-third of warming from greenhouse gases.”

One of those greenhouse gases – methane – has come under greater scrutiny in recent years. In fact, the EPA dedicated nearly 100 actions in 2023 to reducing methane emissions, “including the finalization of an EPA rule that will yield an 80% reduction in methane emissions from covered oil and gas facilities.”

Reducing methane emissions comes with a cost. Not every oil and gas company is the size of Exxon or Chevron. Smaller oil and gas companies faced with a mandate to cut methane pollution may not have the means available to incorporate the latest technologies. Fortunately, help is on the way.

“[T]he EPA and the Department of Energy announced on June 21 that they will fund $850 million worth of projects that can monitor, measure, quantify and reduce these emissions…This funding, which comes from the Inflation Reduction Act, is meant to specifically help small oil and natural gas operators by having them access technology that can reduce emissions. This program is part of an overall…Methane Emissions Reduction Program.”

In a statement, EPA Administrator Michael S. Regan said, “These investments from President Biden’s Investing in America agenda will drive the deployment of available and advanced technologies to better understand where methane emissions are coming from. That will help us more effectively reduce harmful pollution, tackle the climate crisis and create good-paying jobs.”

EHS Today identified four primary objectives of this new funding:

- “Help small operators significantly reduce methane emissions from oil and natural gas operations, using commercially available technology solutions for methane emissions monitoring, measurement, quantification and mitigation.”

- “Accelerate the repair of methane leaks from low-producing wells and the deployment of early-commercial technology solutions to reduce methane emissions from new and existing equipment such as natural gas compressors, gas-fueled engines, associated gas flares, liquids unloading operations, handling of produced water and other equipment leakage.”

- “Improve communities’ access to empirical data and participation in monitoring through multiple installations of monitoring and measurement technologies while establishing collaborative relationships between equipment providers and communities.”

- “Enhance the detection and measurement of methane emissions from oil and gas operations at regional scale, while ensuring nationwide data consistency through the creation of collaborative partnerships. These partnerships will span the country’s oil and gas-producing regions and draw in oil and natural gas owners and operators, universities, environmental justice organizations, community leaders, unions, technology developers, Tribes, state regulatory agencies, non-governmental research organizations, federally funded research and development centers and DOE’s National Laboratories.”

What does this new funding mean for smaller oil and gas companies? They will need to invest money, time, and effort to reduce methane pollution by improving ongoing maintenance in the oil and gas sector. To get the job done correctly, these companies will also need highly skilled workers with hands-on experience with real equipment.

For oil and gas companies looking to improve the skill level of their workers, a thorough review of training systems is a great place to start. Do employees have access to hands-on training with actual components they’ll encounter on the job? If not, partnering with established companies to provide industrial-quality training systems that will stand the test of time will help ensure a competent workforce. Be sure to check out DAC Worldwide’s variety of hands-on oil & gas training systems that feature the real-world components workers will encounter in the field!

- Published in News

Will Oil and Gas Workers Get Left Behind?

When you think of oil production, which countries come to mind? If you’re like many people, you may be thinking of countries throughout the Middle East, such as Saudi Arabi, Qatar, and United Arab Emirates. Would you believe, though, that one of the preeminent oil basins in the entire world is located right here in the United States?

In a recent Forbes article by Ian Palmer, the author notes that the Permian basin, which is located in southeast New Mexico and west Texas, “is the king of crude in the U.S.” Responsible for “producing over 6 MMbpd (million barrels per day),” the Permian has made New Mexico “the second highest oil-producing state in the U.S.”

Experts estimate “that crude oil from the Permian will increase 8% this year…leading to record levels of oil production in the U.S. that will approach 14 MMbpd by 2025…the highest oil production in the world.” However, Palmer points out that the oil and gas industry “predicts peak oil production in the 2030s.” After that peak, “[t]he general idea is that fossil energies would decline as renewable energies would increase.”

What’s driving these changes? (Pun totally intended.) If you guessed electric vehicles (EV), you’d be partially right. In addition to EVs, the push for renewable energy sources also comes from efforts to address climate change, as well as the fact that fossil fuel supplies are not renewable and will one day have to be replaced with alternatives.

Oil giant British Petroleum estimates “worldwide fossil energy consumption falling steadily from 80% now to 28-55% by 2050. Coal will fall the most, oil will fall, and natural gas may or may not fall.” New Environmental Protection Agency rules aimed at vehicle emissions could spur the transition to EVs, though, which could accelerate the decline in oil production.

This might seem like a problem for a state like New Mexico, but Governor Lujan Grisham has made a “strong commitment to address climate change. The state has mandated 80% of electricity to be provided by renewables by 2040, and greenhouse gas (GHG) emissions to be reduced by 45-50% based on 2005 levels.”

As the transition to renewables gains momentum, many in New Mexico are beginning to ask questions about what is to become of the state’s oil and gas workers. According to a recent article from The Wilderness Society, author Nicole Segnini notes that “the oil and gas industry hugely depends on Latinx and immigrant workers. According to New Mexico’s Bureau of Labor Statistics, Latinos represent 46% of the state’s oil and gas workforce, many of whom are immigrants.”

Segnini acknowledges that “New Mexico, and the U.S. as a whole, must transition to renewable energy. But as they make that change, they need to ensure these workers, who have played such a crucial role in the economy, are not left behind. The state must value their expertise and livelihoods as it navigates the necessary transition to a healthier, more sustainable economy.”

For many Latinos and immigrants in New Mexico, “jobs in or supporting the fossil fuel industry are among the very few available to care for their families.” Unfortunately, it’s also this same group “who bears the brunt of the industry’s challenges and pollution.”

Segnini notes that “[o]il and gas workers in Southeast New Mexico…are not sure if they’ll be replaced, if they’ll have to move or if they’ll even get a fair chance at new clean energy jobs.” In fact, “[m]any fear people from outside the state of New Mexico will get those jobs instead, leaving them without a paycheck—and without easy access to training that could help them transition into safe and quality jobs in renewable energy or other industries.”

For example, Gabriela Rueda, originally from Mexico and living in New Mexico for the last five years, says, “Our community needs funds to improve the workforce, have other developments and training with work equipment.” She and others working in the New Mexico oil and gas industry “all have one thing in common: they understand that the oil and gas industry has many flaws and could end. They just want to be considered when that happens.”

Thanks to the advocacy of Somos Un Pueblo Unido, a New Mexico immigrant and worker rights organization, the most recent New Mexico state legislative session secured “$6 million from the state’s budget for New Mexico’s adult education division to expand integrated education and skills building programs for disengaged and difficult to reach adult workers,” as well as “a $1 million pilot program to provide cash stipends to low-income workers enrolled in adult education and integrated education training program.”

Segnini concludes that “it is crucial the state…provides equitable access to workforce development and adult education programs and invests significantly in supplemental income for workers enrolled in training…Providing support, retraining opportunities and pathways to new employment sectors ensures that these workers are not left behind but rather empowered to thrive in a rapidly evolving energy landscape.”

For New Mexico and any other states navigating the transition from fossil fuels to alternative energy sources, the Amatrol family of companies can help with all your training needs. Oil and gas companies will continue to need skilled workers as oil production continues to increase over the coming decade.

As the renewable energy transition ramps up, companies will still need skilled workers. Many of the skills workers will need will be like those needed to produce traditional fossil fuels, while new skills will also need to be mastered. Amatrol, along with its sister companies, DAC Worldwide and Bayport Technical, offer a wide variety of training tools and systems to teach workers the skills they need to succeed.

For example, both DAC Worldwide and Bayport Technical manufacture oil and gas training tools and systems that teach hands-on technical skills with real industrial equipment they’ll encounter on the job. Here are a couple of samples of the types of training aids these companies produce:

- DAC Worldwide’s Extended Wellhead Assembly Cutaway (295-795E) depicts the complete assembly of components used in creating a wellhead, which are used in oil & gas production operations. The full-size, fully detailed example of a high-pressure wellhead assembly gives learners a first-hand view into a component that is found in oilfield applications worldwide.

- Bayport Technical’s Cooling Tower Working Demonstrator (142-CT2) is a scaled, acrylic replica of a forced draft cooling tower used in oil refineries and petrochemical plants. This working demonstrator allows a full view of how water is filtered through the tower to cool it off and then return it the factory. This tabletop system includes a water basin and distribution system, heater assembly, pump, fan, splash bars, air intake louvers, draft eliminators, and temperature gauges.

When it comes to teaching the skills workers need in the alternative energy sector, Amatrol provides a full array (again, pun totally intended) of solar and wind trainers. Here are a couple of examples of Amatrol’s green technology training systems:

- Amatrol’s Solar PV Troubleshooting Learning System (950-SPT1) teaches a range of solar photovoltaic (PV) operation, maintenance, and troubleshooting skills through a unique combination of eLearning curriculum and hands-on experience with real industrial solar PV components. That’s why Amatrol’s Solar PV Troubleshooting Learning System features a wide variety of industry-standard solar PV equipment to teach relevant hands-on skills, including: a mobile workstation with a combiner box, MPPT charge controller, micro inverter, grid interactive inverter, programmer, and communications gateway and hub.

- Amatrol’s Turbine Electric Hub Troubleshooting Learning System (950-TEH1) teaches learners adaptive skills for wind turbine operation, adjustment, and troubleshooting in a wide variety of situations. Turbine Electric Hub Troubleshooting training system allows learners to develop and practice component, subsystem, and system level skills. It is fully functional like a utility-scale turbine electric hub. Turbine Electric Hub Troubleshooting includes Amatrol’s unique electronic fault insertion system, which allows instructors to electronically create realistic hub problems and then track the learner’s progress in solving the problem.

Reach out to an expert training consultant with Amatrol today to get started on the path to training the next generation of workers!

- Published in News

DAC Worldwide Training Tool Provides Unique Insight into Common Valve

Today’s oil and gas workers need in-depth knowledge of and hands-on experience with a wide variety of different types of industrial valves commonly used in the oil and gas sector. When problems arise at an oil refinery, for example, you want skilled technicians able to troubleshoot and repair systems quickly to avoid a potentially dangerous situation.

One of the most common process controllers you’ll find in oil and gas facilities is the liquid level controller. This key device maintains the level of oil or gas in a container by opening or closing a valve known as a liquid dump valve.

Since the liquid dump valve is located near the level measurement device, it’s possible to use mechanical linkages to coordinate the position of a liquid level float in an oil and gas separator with the position of the liquid dump valve.

In a typical mechanical liquid level controller, the liquid level float that sits atop the liquid is connected to a rod that, in turn, connects to the liquid dump valve. As oil or gas level increases or decreases, the float moves the rod that then opens or closes the liquid dump valve.

For example, if the level of oil in a separator increases, the float will rise, causing the rod to open the liquid dump valve to release oil. Then, as the liquid level decreases and the float lowers, the rod will cause the liquid dump valve to begin to close to decrease the rate of liquid release.

Lever-operated dump valves can be found in a wide variety of oil and gas production containers, including separators, accumulators, treaters, and free water knockouts. To teach oil and gas workers how to maintain, troubleshoot, and repair these common valves, DAC Worldwide’s Lever-Operated Dump Valve Cutaway (295-705) is an actual industrial lever-operated oil dump valve that has been carefully sectioned and color-coded to expose and showcase the complete internal configuration of the valve.

Seal features and hardware locations have been retained, allowing for hands-on training in maintenance. Moreover, common valve makes and models are chosen to ensure industrial relevancy. All cleaning, priming, and painting uses a high-durability urethane coating to ensure this training tool will last for years.

The Lever-Operated Dump Valve Cutaway is only one of DAC Worldwide’s many oil and gas training cutaways. Visit DAC Worldwide online to learn more about other oil and gas training tools, such as the Diaphragm Dump Valve Cutaway, Piston Check Valve Cutaway, Oilfield Backpressure Regulator Cutaway, and many more!

- Published in News

Pump It Up! A Primer on the Importance of Pump Maintenance

When you hear the phrase, “pump the jam” your mind could be drawn – if you are of a certain age – to Technotronic’s 1989 club hit “Pump Up the Jam.” But you could also be a machine operator in a jam factory where pumps are used in the production process and must be routinely maintained due to jam viscosity, seeds and fruit chunks, and the sugary buildup on seal faces in sealed pumps.

In addition to jam factories, pumps are used across industry for water movement, chemical processing, and fluid management, as well as for moving harsh, corrosive, or heavy-duty substances. These fundamental components are utilized in agriculture, food and beverage, mining, petroleum, power generation, and pharmaceutical applications to move everything from wastewater to petroleum, sludges to slurries, dairy products to wine, and on and on. Pumps come in an assortment of types and configurations and industry uses a variety of them, such as turbine, piston, and gear pumps.

The most widely used pump across industry is the centrifugal pump, which is a dynamic pump, meaning it adds kinetic energy to the substance that increases the fluid speed and creates pressure. As expected with any kind of mechanical component subjected to constant pressure and operation, wear and tear of pumps is inevitable. However, with a solid understanding of the most common problems occurring from prolonged pump operation and a routine maintenance plan, full scale pump failure and costly production shut downs can be avoided. The most prominent problem with pumps that routine maintenance can prevent is cavitation.

What is Cavitation?

In relation to pumps, cavitation is the phenomena where vacuum bubbles form within fluid being moved through a system. When these bubbles – or voids – collapse they create shockwaves. Over time and repeated use, these shockwaves create premature wear on a pump impeller and lead to component failure if no maintenance is performed. Not only does cavitation lead to component failure, but when present it is extremely noisy and causes vibrations, which results in a loss of process efficiency.

In addition to cavitation, common things that technicians should watch for on industrial pumps include bearing and lubricant condition, shaft seal condition, pump vibration, and pump discharge pressure.

What Pump Maintenance Tasks Can Prevent Cavitation and Pump Failure?

As with any machine, consistent maintenance is key to process efficiency and prevention of equipment failure. In pumps, maintenance can extent equipment life, decrease operating and costs, and prevent specific component ills like cavitation. Generally, it’s recommended to group your maintenance program into three categories: routine, quarterly, and annual. Examples of tasks to track and check include adding oil to the bearing reservoir, cleaning and oiling governor linkages and valve stems, and inspecting disc couplings.

But how can you ensure that maintenance technicians and operators at your facility have the know-how to perform these tasks correctly?

DAC Worldwide’s Pump Maintenance and Operation Training Systems

DAC Worldwide offers an array of options for up-skilling or assessing your employees for pump maintenance and operation, including:

Centrifugal Pump Fundamentals Training System Plus (227-PAC)

The Centrifugal Pump Fundamentals Training System Plus (277-PAC) offers hands-on training for basic centrifugal pump operation and maintenance. This system can be used to demonstrate pump cavitation, fundamental operational principles, and the effects on flow and pressure by varying static head and piping configuration. The Centrifugal Pump Fundamentals Training System is a perfect solution for introductory operations and maintenance courses related to centrifugal pumps and process systems.

This system features a centrifugal pump with an open impeller, a variable speed DC pump motor with a controller, and a modular, clear PVC piping system with a variable-height support structure that allows for multiple configurations of the tank, pump, and motor to create new flow and static head conditions. The system also offers optional pipe spool variations to create even more process flow conditions.

Pump Maintenance Training System Plus (275-PAC)

DAC Worldwide’s Pump Maintenance Training System Plus (275-PAC) is a benchtop training device featuring a standard ANSI centrifugal pump mounted on a heavy-duty, 7-gauge, formed-steel, powder-coated baseplate. This systems features real-world pump components for practicing the disassembly, packing, and reassembly of common centrifugal pumps, as well as common pump maintenance such as impeller clearance adjustment and mechanical seal replacement. This system also features a clear acrylic backhead for visibility of the seal area.

Pump Maintenance and Alignment Training System Plus (275E-PAC)

The Pump Maintenance and Alignment Training System Plus (275E-PAC) is a benchtop training system featuring a standard ANSI centrifugal pump and a simulated motor element. This combination along with a replaceable ¾-in. diameter steel shaft with keyways allows users to practice shaft alignment skills. Further, the motor element features flanged bearings that can be adjusted to allow for angular and parallel misalignment. This system also allows users to practice complete pump tear-down and assembly. The Pump Maintenance and Alignment Training System also features a clear acrylic backhead to show pump packing procedures and the installation of mechanical seals.

Additionally, DAC Worldwide has dissectibles, component cutaways, and sample boards for expanded industrial pump training. DAC’s sister company, Amatrol, also offers pump systems that can bolster your industrial training program.

Amatrol’s Centrifugal Pump Learning System (950-PM1) and Expansion Systems

Amatrol’s pumps learning systems cover industry-relevant skills including how to operate, install, maintain, troubleshoot, and select a variety of pumps, as well as system design. The base learning system features a centrifugal pump, but allows for the use of several different pumps for expanded training; these pumps include: parallel pumps, turbine pump, diaphragm pump, peristaltic pump, piston pump, gear pump, magnetic pump, and centrifugal pump with stuffing box.

- Published in News

DAC Worldwide’s 4-Variable Process Control System: The Ultimate Instrumentation Training Tool

Let’s say on the way to pick up you prescription at the drug store, you stop at the gas station, fill up your tank, and pick up a cold soda pop. By the time you get home, you’ve interacted with at least three products that use process control and instrumentation in their creation. Oil and gas, pharmaceuticals, and food and beverage are only three of the countless number of industries that rely on process control and instrumentation to produce their goods.

What is process control and instrumentation?

According to the Process Industry Informer’s Phil Black, “Process control is used in continuous production – in manufacturing and in other fields and industries where some kind of material is produced without any kind of interruption – as well as in ‘batch processing.’ It’s used to automatically control the conditions in which a product is made – ensuring better quality and efficiency.”

And the applications of these processes are only getting started. According to Amatrol’s Duane Bolin, “Process control is big business all over the world. The global economic value of the process control systems market is estimated to be more than $120 billion. This value will only continue to grow as automation and Industry 4.0 technologies enable process control systems to further increase the productivity and efficiency of manufacturing facilities.”

And the applications of these processes are only getting started. According to Amatrol’s Duane Bolin, “Process control is big business all over the world. The global economic value of the process control systems market is estimated to be more than $120 billion. This value will only continue to grow as automation and Industry 4.0 technologies enable process control systems to further increase the productivity and efficiency of manufacturing facilities.”

Why is process control important?

Much like its applications, the importance of process control is nearly limitless in industry, but here are three major reasons:

-

Improved Process Efficiencies

Process control allows for improved process efficiencies because the data produced by sensors can be analyzed resulting in more effective decisions.

-

Limited Staff

Because processes can be automated, a small staff of operators can control the most complex processes from a central location.

-

Ensures Safety

Manipulating substances to produce a product is a very demanding and potentially hazardous process. The controlled environments and components within process control limit danger to operators.

How do I set up process control training for our school or industry training center?

So you have a workforce or classroom full of people that need to be upskilled on process control and instrumentation practices. Where do you begin? Technical training innovators like Amatrol, DAC Worldwide, Bayport, and Pignat offer a variety of concentrated, single-topic options for process control training like Amatrol’s Temperature (T5553) or Pressure (T5555) systems, DAC Worldwide’s Calibration Training (616-000) system, Bayport’s Flow Level Trainer (120-CFLCD), or Pignat’s Gas-Liquid Absorption (ABS/2000) system. However, there is one system that not only offers hands-on skill building across all forms of instrumentation training, but is also customizable to an almost limitless degree to exactly meet your training needs:

DAC Worldwide’s 4-Variable Advanced Process Control Training System (603-000)

DAC Worldwide’s 4-Variable Advanced Process Control Training System (603-000) allows candidates to build hands-on skills in flow, level, pressure, and temperature process control applications. This system features an open physical architecture and wiring design, which allows for incredible adaptability and customization. This system can be configured to meet almost any process control training need or industry application and allows you to modify it as needs or technology changes.

The large size of the system and more complex measurement and control environment enables for PLC and DCS control systems, which means it can be set up for one large complex loop or two individual loops. This system can also feature Hart, Foundation Fieldbus, and Profibus communication systems.

The DACW 4-Variable Advanced Process Control Training System can be used for everything from interpreting PNID drawings, to teaching system walkdowns and PID control methodology, to the creation and maintenance of instrument loops, as well as large-scale system troubleshooting. This instrumentation training system includes a dynamic and complex piping system with a PID on each side, which allows for experiments in true cascade control – a topic that is uniquely covered by the 603-000 in the technical training industry.

There are also instrumentation packages – including Endress Hauser, Rosemount, & Honeywell – available to fully meet the training needs that most closely resemble the equipment you’ll see in your company or local industry.

Even More Process Control Option from DAC Worldwide!

If 4-Variable Advanced Process Control Training System is a bit more than what your training program needs, DAC Worldwide offers a full line of process control and instrumentation options. Some of these include single-topic options such as Analytic Process Control (605-000), Temperature Process Control (602-PAC), and a PID Controller Trainer (608-000).

How Can DAC Worldwide Help Your Training Program?

With more than four decades of experience in industrial training, DAC Worldwide’s reach extends far beyond just electrical products. In fact, DAC Worldwide possesses knowledge and expertise in a wide range of technical topics, including Electronics, Fluid Power, Heat Transfer & Steam, HVAC, Machining & Measurement, Mechanical Drives, Oil Production, Process Control & Instrumentation, and Pumps, Compressors & Valves.

Our training aids range from training systems and sample boards, to models and dissectibles – with real-world, hands-on learning being the core of each product. For more information on how DAC Worldwide can enhance your industrial training program and provide you with the best training solutions available, please click here.

- Published in News

Bridging the Oil and Gas Skills Gap: Effective Technical Training for Current and Future Employees

Click HERE to view Bridging the Oil and Gas Skills Gap: Effective Technical Training for Current and Future Employees as a multimedia presentation.

Click HERE to view Bridging the Oil and Gas Skills Gap: Effective Technical Training for Current and Future Employees as a multimedia presentation.

What does 2020 and the coming years hold for industries around the globe? That’s the question on the minds of many executives as they embark on a new year and a new decade. For the oil and gas industry, a skills gap will continue to create problems for employers looking to seize new opportunities for increased efficiency and profitability. Effective technical training for current and future employees will be a key strategy necessary to solve this problem.

In this article, we’ll take a closer look at what 2020 holds for the oil and gas industry, including the reasons behind and current state of the skills gap in the industry. We’ll consider how companies are using training programs to upskill current workers and ensure future workers have the skills they need. Finally, we’ll look at how DAC Worldwide’s unique oil and gas training tools can help employers and educators to bridge the skills gap facing the oil and gas industry.

2020: Opportunities and Challenges

The oil and gas industry has rebounded from the economic downturn experienced several years ago. According to Deloitte’s 2020 Oil, Gas, and Chemical Industry Outlook, there are several reasons for optimism in the new year: “Liquid natural gas (LNG) keeps growing…[f]ossil fuel consumption is expected to continue to grow…[and] [g]lobal…oil supply remains secure thanks to growing US production and healthy stocks.”

The Deloitte report concludes that oil and gas executives need to be “ready to embrace new opportunities for profitable growth…Thanks to the lessons learned from the most recent boom and bust cycle, the industry is better equipped to face the future than it has been at any other point in the past decade. Still, there are fundamental, long-term challenges that they will have to face.”

The 2019 Global Energy Talent Index (GETI) Report agrees, noting that “[t]he oil price has rebounded and new projects are on the rise. The challenge now for the sector is to ensure that the talent supply can keep up with demand.” Why? Quite simply, “[m]aintaining a pipeline of new talent has become a challenge for oil and gas companies.”

The Oil and Gas Skills Gap

A recent Energy Sourcing article notes that, in the coming decade, the “U.S. Bureau of Labor Statistics expects 54.8 million total job openings [in the oil and gas industry],” but there are “not enough skilled people to fill them.” What is behind this skills gap? Experts point to a variety of factors that have contributed to the growing shortage of skilled talent in the oil and gas industry.

Too Few Millennials, Too Many Boomers

According to the 2019 GETI Report, “the impact of economic cycles on job stability is a leading cause of the skills shortage.” During the recent economic downturn, jobs were cut and recruitment efforts were severely curtailed. The result has been the slowing of “[t]he influx of young talent into the sector,” leading to the present “talent crunch.”

Now that the industry is back on the upswing, employers are trying once again to attract young talent, but they’re finding it’s not as easy as it used to be. As a recent Airswift article notes, oil and gas employers are learning a hard lesson: “The skills gap is a problem that money alone can’t solve.”

Not only is oil and gas “the number-one industry millennials wished to avoid working in because of its image,” but competition for young, skilled talent is fierce because the skills gap affects nearly every industry around the world.

Adding to the problem of the short supply of young talent is the fact that “[o]lder workers from the Baby Boomer generation are beginning to reach retirement age, ultimately heading off and taking decades of knowledge and experience with them.” Who will replace them?

Industry 4.0 Changes

Industry 4.0 Changes

Whoever does replace retiring workers will have to possess a stronger technical skillset than ever before. In addition to skills specific to the oil and gas industry, they will need advanced technological skills that will enable them to succeed as the industry experiences the dramatic changes characteristic of the Fourth Industrial Revolution, otherwise known as Industry 4.0.

Industries across the board and around the world are being impacted greatly by Industry 4.0’s technological advances. Oil and gas is no exception. As the Airswift article notes, “oil and gas companies are collecting more and more digital data which is helping to improve worker safety, monitor reservoir behaviour, plan ahead for smoother digs, maintain hardware and much more.”

They’re also incorporating new technologies, such as drones. According to the Oil and Gas Drone Services Market – Growth, Trends, and Forecast (2019-2024), the market for drone services in the oil and gas industry is expected to grow by more than 60% in the next five years.

As a Business Wire article summarizing the drone forecast notes, “[d]rones are being used for inspection to determine any damage or corrosion and to provide data for structural integrity and visual and infrared photography,” as well as for “pipeline inspection, corrosion checks, security checks, and maintenance issues.”

Positions Aplenty

Positions Aplenty

In addition to new positions, such as drone pilot and drone fleet manager, the oil and gas industry features a wide range of high-priority roles impacted by the skills gap. According to a recent study by RAND Corporation, the sector needs plenty of “lease operators (also known as well tenders), equipment operators, maintenance and service technicians…electrical engineers…welders, pipeline layers…commercial drivers…machinists [and] warehouse operators.”

The 2019 GETI Report also notes that “the pool of available, blue-collar talent has shrunk rapidly. These skills are proving to be the most urgent of needs…In the US, blue-collar skills are more in demand than engineering roles.”

The Airswift article summarizes things succinctly:

“There is a very real problem standing on the doorstep of oil and gas companies, and it is one that needs a huge amount of effort and foresight to solve for long-term growth and success. We’re talking about the industry skills gap which is crippling energy companies, holding up work and causing projects to go over budget…More than half of professionals in the industry across the globe believe that a growing skills shortage is by [far] the biggest challenge the industry faces both now and in the future.”

Technical Training to the Rescue

As the Airswift article makes clear, oil and gas companies are learning that the skills gap is a problem that won’t go away just by throwing money at it. It requires a multifaceted approach with coordination between a variety of stakeholders, including employers, educators, workforce development programs, and even local, state, and federal governments.

Ongoing Training Is Key

Ongoing Training Is Key

While long-range plans are set into motion, employers still must do what they can in the meantime. Airswift notes that the 2019 GETI Report’s survey found that nearly two-thirds of respondents believe “companies should be turning their attention internally and retraining existing employees to deliver the skills they need to bridge the gap.”

The author of the Energy Sourcing article agrees: Training current and new employees with cross-functional skills “may be the quickest answer to the industry’s current hiring challenges.” Another strategy many employers consider is luring skilled talent away from other industries.

However, bringing in people from other disciplines isn’t a “plug and play” phenomenon. Instead, the Energy Source article points out that “when it comes to the required knowledge to be proficient in oil and gas exploration and development, they will need additional training in certain areas to enter this industry ready to be contributing members of the team.”

The oil and gas industry differs from other industries in that the wide variety of specialized skillsets it requires make initial and ongoing internal training a necessity. Two recent studies reveal the nature of this need.

The RAND Corporation study concludes:

“About half of employers (52 percent) reported employing high-priority occupations that require moderate-term on-the-job training (including inspectors, welders, and roustabouts) and about one in four employers (28 percent) reported having high-priority occupations that require long-term on-the-job training (including mechanics, machinists, and wellhead plumbers). Thus, for many of the oil and gas sector employers…it is essential to invest in and commit to providing on-the-job training to ensure their workers can adequately perform their duties.”

Similarly, SPE Research’s Training and Development Survey notes that “[u]pon starting a career [in the oil and gas industry], the majority (86.8%) of employees require training…[and] “[n]early a fifth (19.2%) required extensive training”…[and] [m]ost (82.4%) expect their employer to provide them with some of this training.”

More Than a Short-Term Solution

More Than a Short-Term Solution

The RAND Corporation study goes on to explain that training is much more than just a short-term solution:

“[A] sizeable number of high-priority occupations require long-term training…underscor[ing] the need for ongoing training and professional development after hiring to ensure that employees are getting training both for the jobs they currently have and for the jobs they might take in the future. Focusing on the workforce as a pipeline that supports careers rather than a single hiring transaction at entry is essential for sustaining the oil and natural gas industry over the long term.”

The SPE Research survey also makes a strong case for focusing on employee training as a means of not only empowering employees with the skills they need but also meeting their expectations for career development: “Overall, a wide range of skills are important for a successful career in the oil and gas industry; therefore employees place great emphasis on training and development opportunities when choosing their employers.”

The survey notes that “[i]t is important for companies to have good training and development programs, as three-quarters (74.6%) of employees state that it is important in their choice of role, and over half (53.3%) say that a lack of opportunities would be enough for them to consider leaving.”

Gaining Momentum

Gaining Momentum

It appears employers are getting the message, since “[e]ight out of ten companies provide at least some formal training as their overall approach to employee development,” and “[t]echnical training is the most common form of training provided by employers.”

This response is being echoed by other industries, including advanced manufacturing. For example, The Manufacturing Institute Training Survey recently made these key findings regarding training programs in the advanced manufacturing sector:

- “Nearly 70% of manufacturers are addressing the workforce crisis by creating and expanding internal training programs for their workforce, among other tactics.”

- “More than 79% of respondents said that they have increased their training activities.”

- “Three-quarters of respondents said that upskilling workers helped to improve employee productivity, with promotion opportunities and morale also leading the list of reasons why companies might embrace training programs.”

- “In dollar terms, the Institute estimates that the sector spent at least $26.2 billion in 2019 on internal and external training programs for new and existing manufacturing employees.”

Oil and gas companies would do well to follow the example set by manufacturers by taking on the responsibility “to build stronger pipelines to address not only the needs of their businesses but also the needs of their workers.”

Quality Matters

Quality Matters

What kind of training is necessary? The answer to that question will vary widely amongst oil and gas companies. Is your company upstream, midstream, or downstream? What roles are you having trouble filling because of the skills gap?

What will not change from company to company is the need for high-quality training that efficiently and effectively teaches current and future employees the skills they need to succeed on the job. This is particularly true for the oil and gas industry, given its broad scope of roles with specialized skill requirements.

Unfortunately, many training programs don’t meet the needs of the oil and gas industry. As the RAND Corporation study notes, “[l]ess than half of courses aimed at future workers in the oil and natural gas industry use contextualized instruction. Contextualized instruction uses occupational applications to teach basic academic skills (and vice versa) in such a way that the student learns both simultaneously.”

Teaching relevant skills in the context of the oil and gas industry is especially important because the industry is unique in so many ways. The most effective training will provide employees with hands-on experience with real oil and gas components. The RAND Corporation study supports this approach: “past research shows that contextualized instruction is an effective approach to teaching occupationally focused students…particularly when it includes ‘real-world’ simulations of workplace situations with actual workplace equipment.”

DAC Worldwide: Your Source for Effective Training Tools

DAC Worldwide: Your Source for Effective Training Tools

Oil and gas companies don’t need to recreate the wheel when looking for quality, effective technical training tools. Instead, they can rely upon a trusted training partner like DAC Worldwide to provide the guidance they need.

DAC Worldwide offers a wide variety of technical training tools specifically for the oil and gas industry. Importantly, these tools provide the contextualized, hands-on training current and future employees expect, want, and need.

Contact a DAC Worldwide representative to consult with you regarding your specific training needs. In the paragraphs that follow, we’ll take a look at just a small sample of the many training tools offered by DAC Worldwide, including training systems, cutaways, dissectibles, models, and sample boards.

Training Systems

Training Systems

Rather than broad-based training in multiple areas, DAC Worldwide’s training systems provide hands-on training focused on specific tasks. This makes them particularly helpful to employers for skill assessment (either pre-employment or for upskilling purposes).

For example, DAC Worldwide’s Vertical Separator Trainer (295-101) consists of a reduced-scale, three-phrase vertical separator that mimics its real-world counterpart by using alternate production stream components, refined oil, air, and water. It also features real industrial components, such as on-board supply pumps, a regenerative blower, a static mixer, metered valves, flowmeters, an inlet diverter, overflow weir, mist eliminator, and a custom-fabricated, large-diameter, clear acrylic, vertical separator vessel.

Cutaways

Cutaways

DAC Worldwide’s industrial component cutaways provide hands-on experience with real, industrial components that have been professionally sectioned to expose key internal components to help learners understand how they work. For industrial training relevance, common models by well-known manufacturers are chosen when manufacturing cutaways.

There are two dozen cutaways related to oil production to choose from, including a wide variety of regulators, valves, and gauges. For example, the Extended Wellhead Assembly Cutaway (295-795E) consists of a full-size, fully-detailed example of a high-pressure wellhead assembly that gives learners a first-hand view into a component found in oilfield applications worldwide. It features a variety of real industrial components learners will encounter on the job, including a casing head/starter head, tubing head, tree bonnet adapter, adjustable choke, and gate-type block valve.

Dissectibles

Dissectibles

DAC Worldwide’s dissectibles take cutaways to the next level by allowing learners to disassemble and reassemble real industrial components. There’s simply no better way to train someone on the maintenance of a particular component than letting them disassemble and reassemble an actual unit. Plus, dissectibles provide experience with real components without damaging actual equipment.

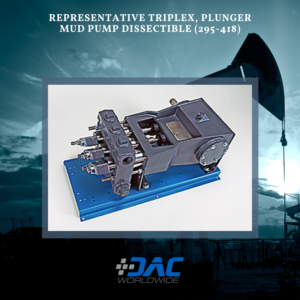

For example, the Representative Triplex, Plunger Mud Pump Dissectible (295-418) is an economical, conveniently-sized triplex plunger-type mud pump assembly that teaches learners hands-on maintenance activities commonly required on larger mud pump assemblies used in upstream oilfield production operations. DAC Worldwide’s dissectible mud pump is a realistic sample that’s similar in geometry, design, and operating characteristics to the larger varieties learners will encounter on the job.

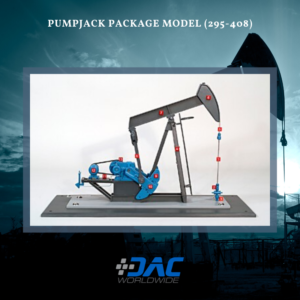

Models

Models

DAC Worldwide also offers a variety of incredibly-detailed, intricately-crafted models. Sometimes industrial training tends to focus so intently on the details that learners can’t see the forest for the trees. Models allow students to learn how the parts of a system work together on a small, easily-managed model without the need for a field trip to an industrial site.

There are more than a dozen models related to oil production to choose from, including separators, tanks, turbines, pumps, and piping systems. For example, the Pumpjack Package Model (295-408) is a highly-detailed, professionally-crafted technical scale model of a common oilfield production pump. Fully-detailed, this benchtop model depicts all primary pump features including counterweights, double-reduction gearbox, walking beam, horse head, sampson post, prime mover, pitman arm assembly, and representative wellhead.

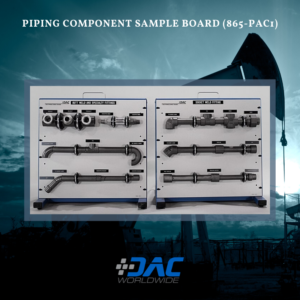

Sample Boards

Sample Boards

DAC Worldwide’s sample boards offer valuable maintenance training in the identification and selection of a variety of industrial components. Each sample board features a selection of real industrial components mounted with nameplates for easy association with individual components.

For example, the Piping Component Sample Board (865-PAC1) is a hands-on teaching aid designed to supplement courses in piping design, process operations, and pipe installation to help industrial maintenance technicians identify and select industrial piping components. Components from four common piping systems are provided. These samples represent a variety of piping system designs and include a broad range of fittings.

We encourage you to connect with DAC Worldwide via its social media channels, including YouTube, Instagram, LinkedIn, Twitter, and Facebook.

- Published in News